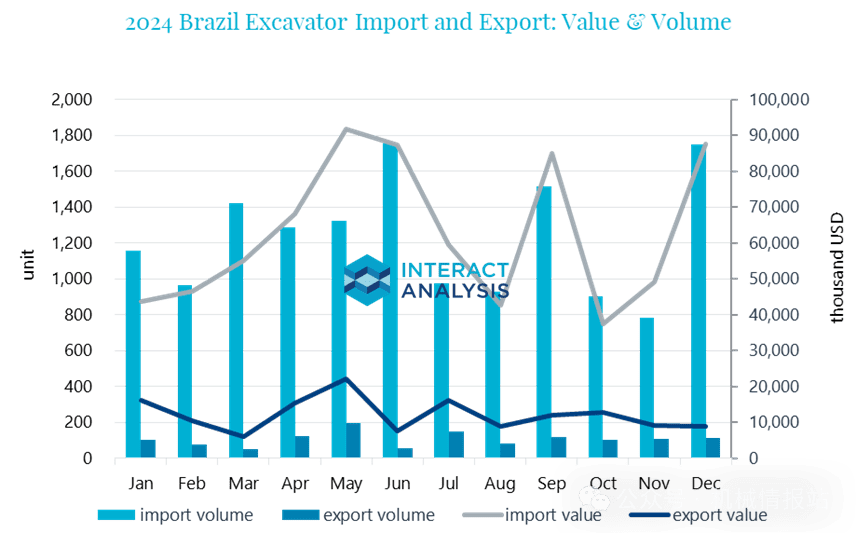

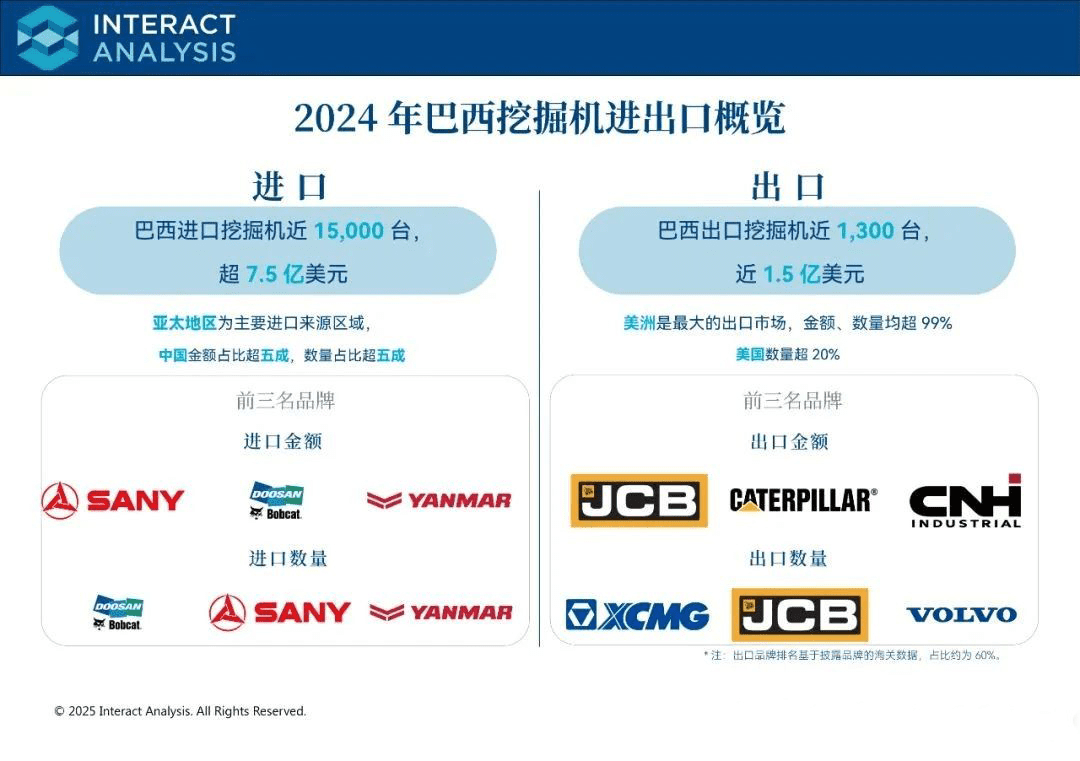

The Brazilian excavator market presents obvious import-oriented characteristics. In 2024, Brazil will import nearly 15,000 excavators, with a cumulative import value of more than 750 million US dollars, five times that of excavator exports. On a monthly basis, the performance of the import market in the first half of the year was significantly better than that in the second half of the year, and the whole first half of the year showed a fluctuating upward trend. The peak number of imports occurred in June, with more than 1,700 excavators imported in a single month, and the peak value occurred in May, with a monthly import amount of more than 90 million US dollars. The export market was stable, with the peak of volume and value in May.

By region, Asia-Pacific was the largest source of excavator imports for Brazil, accounting for approximately 70% in both volume and value. Heavy machinery made in China, with its share of import volume and value reaching around 50%. Additionally, the Czech Republic was Brazil’s second-largest source of excavator imports, accounting for about 26% in volume and 19% in value, primarily due to Doosan excavator production base in the country. On the export side, the Americas were the largest market for Brazilian excavators, accounting for 99% of both export volume and value. The United States had the highest share in volume at over 20%, while Mexico led in value at nearly 20%.

Chinese, Japanese, and Korean Brands Dominate Imports

Chinese, Japanese, and Korean companies led Brazil’s excavator import market in 2024. In terms of volume, the top three imported brands were Doosan Bobcat, Sany, and Yanmar, collectively accounting for nearly 60%. By value, the top three brands were Sany, Doosan Bobcat, and Yanmar, with a combined share exceeding 50%. Notably, the Doosan Bobcat excavators imported by Brazil were mainly produced at its Czech base, while Caterpillar and Hyundai-branded excavators were primarily sourced from their Chinese production bases.

By model, the Japanese and Korean-branded excavators imported by Brazil were predominantly Mini excavator, with key models including Doosan Bobcat’s E35Z and E26, and Yanmar’s VIO30-6B and VIO35-6B. In contrast, excavators from Sany and Liugong covered the full tonnage range, with key models ranging from Sany’s SY16C micro excavator to the SY1250H large mining equipment.

On the export side, Brazilian excavator exports were still dominated by foreign brands, with XCMG and JCB leading in export volume. Both brands began localized production in Brazil around 2010. In 2012, XCMG established its first overseas wholly-owned production base in Brazil, which commenced operations in 2014. JCB, after putting its Sorocaba, São Paulo factory into use in 2012, invested an additional $25 million in the facility in 2019.

Keywords: