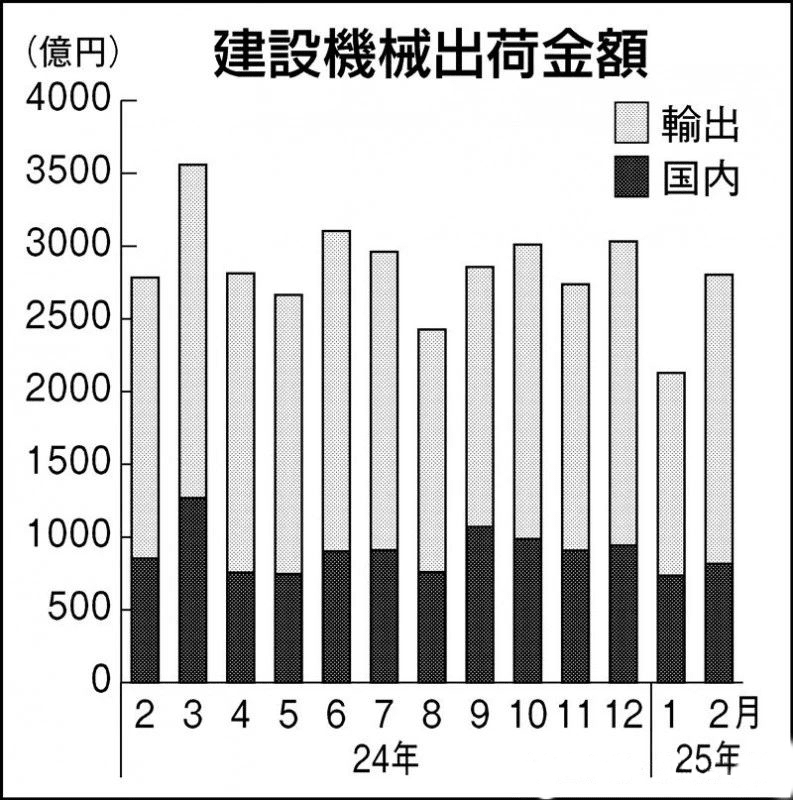

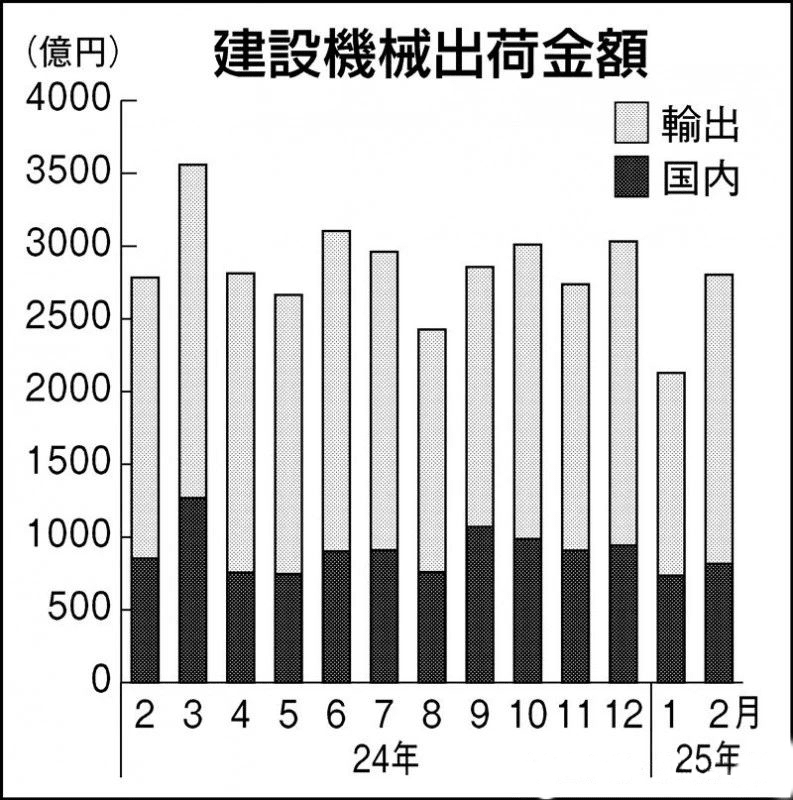

Data released by the Japan Construction Equipment Manufacturers Association (CEMA) on March 31 shows that construction machinery shipments in February totaled ¥280.43 billion, a year-on-year increase of 0.7%, marking the first growth in seven months. Although domestic shipments fell 4.3% (¥81.62 billion), continuing a seven-month decline, exports rose 2.9% (¥198.81 billion), shifting to positive growth for the first time in 13 months and driving overall performance. CEMA stated, “Increased exports to Asia and Europe were the main contributing factors.”

Sharp Increase in Asian Exports, Significant Demand in Indonesia

Exports to Asia surged by 64.6% to ¥25.9 billion. CEMA noted, “Member companies reported notable growth in the Indonesian market.” Demand for machinery has risen due to farmland development for improving food self-sufficiency, alongside increased needs for mining dump trucks.

European Market Recovery, Mining Equipment Orders Rebound

Exports to Europe, long impacted by high interest rates and economic stagnation, grew 20.0% to ¥28.1 billion, the first increase in 16 months. CEMA highlighted, “While specific countries were not named, orders for mining dump trucks have started to recover.”

North American Market Remains Sluggish, Inventory Adjustments Ongoing

Exports to North America, the largest market, fell 16.7% (¥65.6 billion), extending a seven-month decline. Challenges include unfinished inventory adjustments at rental outlets and weak demand for Mini excavator in housing-related sectors. CEMA commented, “A demand recovery awaits further interest rate cuts.”

Other Regional Performances

Exports to Oceania, Central/South America, and China also grew, driven primarily by mining equipment demand in Oceania and Central/South America.

Domestic Demand: Decline Narrows, Cranes Shine

While domestic shipments continued to drop, CEMA noted, “Categories like construction cranes saw growth, and the overall situation is not severely worsening.”

Category Analysis: Spare Parts Surge Signals High Operating Rates

By product type, spare parts exports jumped 28.0% (¥26.6 billion), reflecting high global machinery utilization rates. The recovery trajectory in North America will be a key indicator to watch.

Keywords: