Domestic economic slowdown and rising trade barriers are accelerating the global expansion strategies of Chinese construction machinery manufacturers.

Drivers of the “Going Global” Strategy

Chinese construction machinery manufacturers are actively seeking partnerships with global rental companies and dealers to advance their ambitious overseas plans. Domestic market volatility, the need to circumvent high tariffs in Europe and the U.S., and infrastructure projects under the Belt and Road Initiative are pushing more companies to look beyond China. Although rapid economic growth and cheap labor were sufficient to support the expansion of companies like XCMG, Sany, and Shantui from the 1990s to the early 2000s, the post-pandemic economic slowdown has made “going global” an industry consensus.

Confidence in Breaking Barriers

Despite trade restrictions and geopolitical tensions, manufacturers believe technological innovation and localized cooperation will be key to their overseas expansion.

In February 2024, Sany Heavy Industry announced plans to raise $1.5 billion through an IPO on the Hong Kong Stock Exchange to fund its globalization efforts. Jiang Qingbin, Vice President of Sany Group, stated the goal is to double overseas revenue from $7 billion to $14 billion by 2028, with “collaboration with local dealers and rental companies” as the core strategy.

Currently, Sany’s overseas sales are growing at an annual rate of 12%, accounting for 65% of total revenue. XCMG, meanwhile, is accelerating its penetration into the European market. Chairman Yang Dongsheng admitted, “Initially, European customers knew nothing about our brand, but now they are starting to trust us.” XCMG plans to establish a financial leasing company in Europe, becoming the first Chinese manufacturer to offer direct financial services there.

However, U.S. tariffs on Chinese imports (currently at 30%) have forced XCMG to reassess its target of 55% international revenue by 2025.

Localized Production to Counter Tariffs

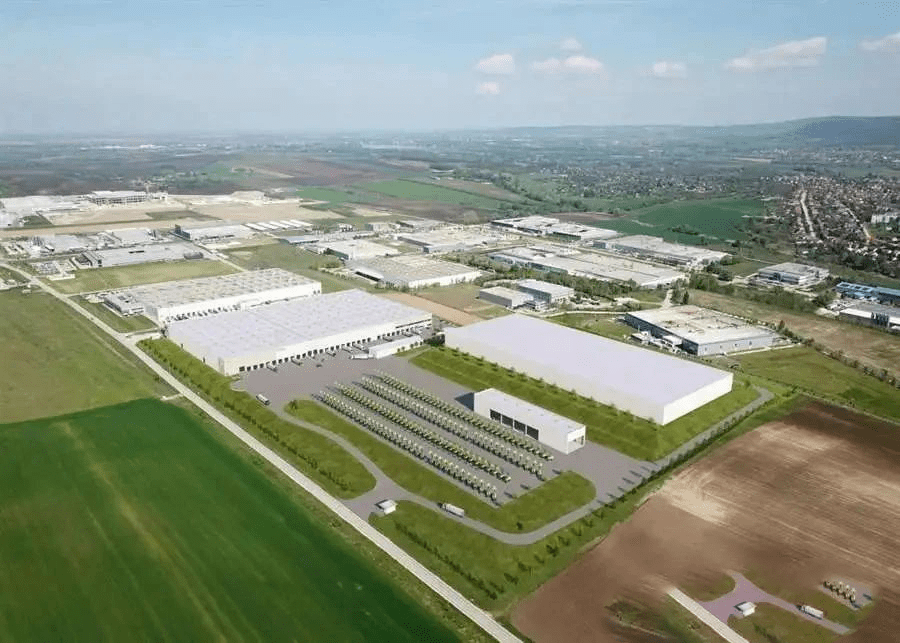

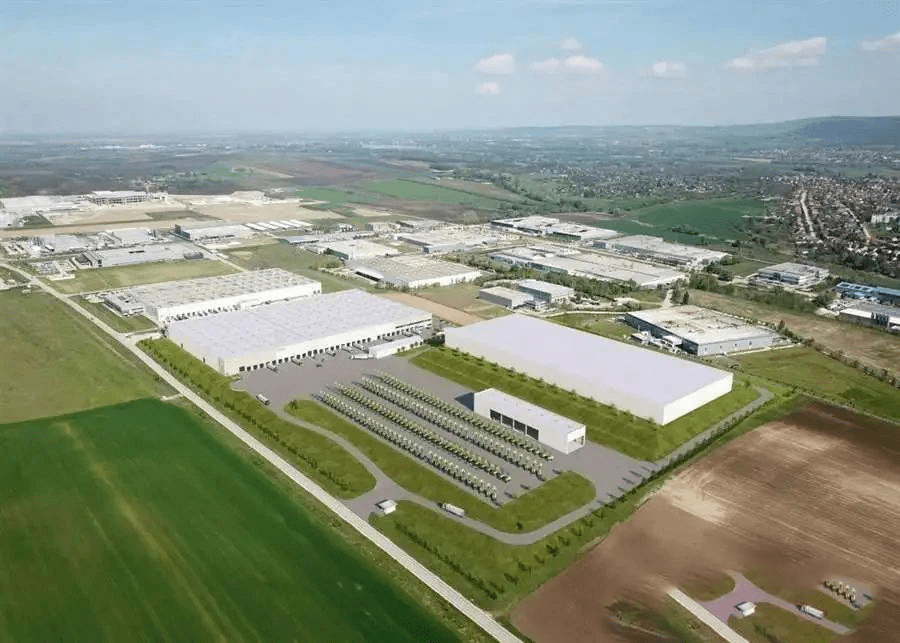

To bypass trade barriers, some companies are setting up overseas production facilities. Zoomlion invested €100 million in a new aerial work platform production base in Hungary after the EU imposed tariffs on Chinese MEWP manufacturers, including Zoomlion. Luo Kai, the company’s Co-President, said, “We are implementing an ‘end-to-end, digital, localized’ strategy to directly connect with customers and markets.” Among Zoomlion’s 11 overseas R&D and manufacturing bases, seven are in Europe, including CIFA’s concrete equipment plant in Italy and M-TEC’s dry-mix mortar equipment plant in Germany.

Southward Strategy and Belt & Road Opportunities

Political factors are also driving manufacturers toward Global South markets. Sany had already expanded into India and Southeast Asia before the tariff wars, with its 90-acre plant in Pune, India, commencing operations in early 2024. Jiang Qingbin noted, “Developing countries have higher acceptance the brand of Road construction equipment made in China, with significant demand growth.” Zoomlion has identified Russian-speaking regions, Southeast Asia, and South America as key markets.

Political factors are also driving manufacturers toward Global South markets. Sany had already expanded into India and Southeast Asia before the tariff wars, with its 90-acre plant in Pune, India, commencing operations in early 2024. Jiang Qingbin noted, “Developing countries have higher acceptance of Chinese brands, with significant demand growth.” Zoomlion has identified Russian-speaking regions, Southeast Asia, and South America as key markets.

Keywords:

- Construction machinery

- Sany Heavy Industry

- Construction equipment made in China

- Road construction equipment made in China