The Golden Days of the Past

For many years, China has been the world’s largest consumer of Engineering vehicle equipment. Western companies once effortlessly sold their products to China. Many foreign manufacturers were convinced that “the good times would never end,” investing heavily in developing distribution networks in China and establishing production bases tailored specifically to the Chinese market. This strategy worked for a long time, making China a veritable “cash cow” for numerous Western manufacturers.

Meanwhile, Chinese construction machinery companies faced persistent challenges in breaking into Western markets. Although their product quality was acceptable, their technological sophistication lagged behind. Despite tremendous efforts, until recently, Chinese firms struggled to overcome trade barriers in major markets like Europe and North America, as well as the deeply ingrained loyalty of local consumers to established international brands and their dealerships.

A Shift in the Landscape

The latest market statistics reveal an industry in transformation. Over the past six to eight years, the market share of non-Chinese brands in China has been steadily declining, a consequence of the significant improvement in the quality of Chinese construction machinery. The golden era of “high premiums, high profits” once enjoyed by Western manufacturers has come to an end.

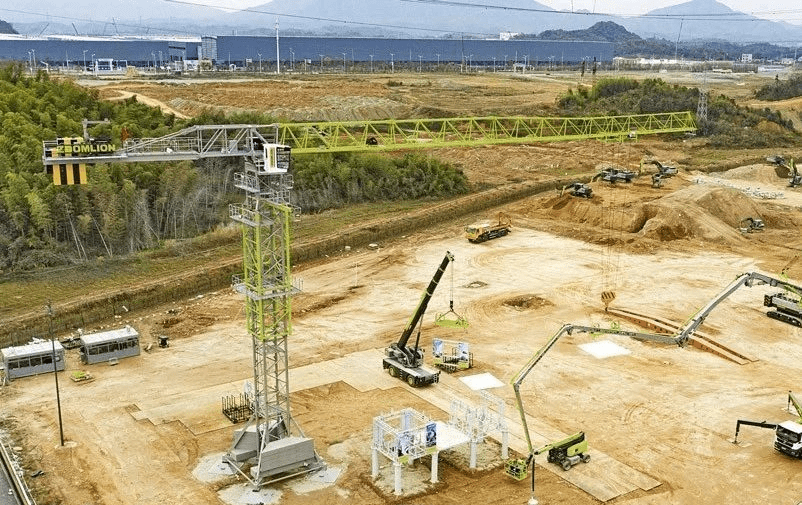

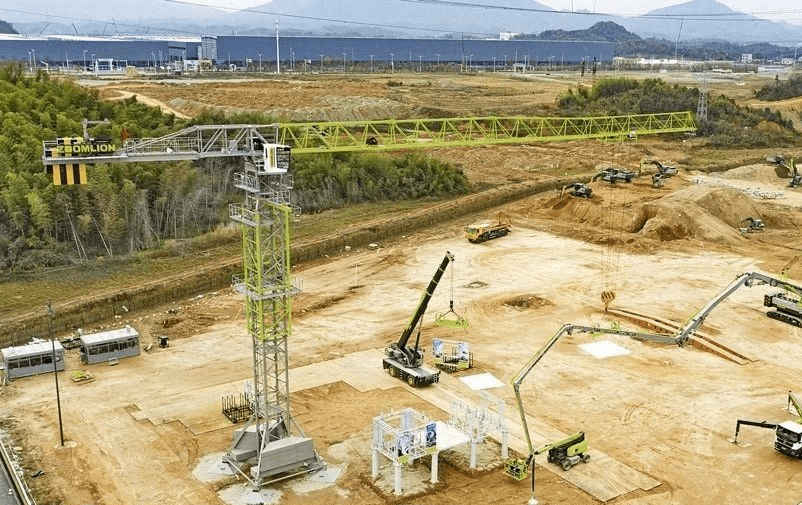

Today, Construction equipment made in China has achieved a qualitative leap in both quality and performance, with many metrics now on par with Western competitors. Leveraging this advantage, Chinese companies are accelerating their expansion into new markets in Europe and America. Before 2021, most Chinese manufacturers were trapped in a “brand recognition dilemma”: low brand awareness made it difficult to attract dealers, while the lack of high-quality dealerships, in turn, hindered brand promotion.

However, the global supply chain crisis from 2020 to 2023 became a turning point, as production shortages in the West created substitution opportunities for Chinese equipment. Although data shows that the market share growth of Chinese construction machinery in Europe and America remains modest (reaching around 5% in Europe), it signifies that Chinese brands have finally broken through the entry barriers of traditional high-end markets.

A New Strategy for Breakthrough

Heavy machinery made in China have adopted a shrewd market strategy: focusing on providing high-performance products to equipment rental companies. This direct sales model successfully bypasses the traditional dealership system, allowing companies to reach end-users directly while building brand equity. This innovative sales approach not only breaks the vicious cycle but also provides Chinese brands with a critical channel to shape their market image.

These changes may signify that the era of Chinese construction machinery manufacturers has finally arrived—both in their home market and abroad. However, it is worth noting that this scenario is only possible in the absence of stringent trade barriers, such as punitive tariffs.

Keywords:

- Construction machinery made in China

- Engineering vehicle equipmentmade in China

- Construction equipment made in China

- Heavy machinery made in China